The Better Sleep Council regularly conducts a variety of consumer research to help mattress manufacturers and the broader bedding industry to better respond to the needs of consumers, anticipate coming trends and hone marketing efforts. In the latest installment of comprehensive research, the BSC examines how the Covid-19 pandemic has altered and accelerated consumers’ attitudes and behaviors related to sleep, health and mattress shopping. The research, conducted in 2020, is part of a series dating back to 1996 that allows the industry to track changes and trends over time. In the second half of 2020, the BSC conducted a second survey focused on how consumers use online reviews to research mattresses and make buying decisions. Together, results of the two the surveys provide valuable insights manufacturers can use to improve their operations and better serve shoppers. Read on.

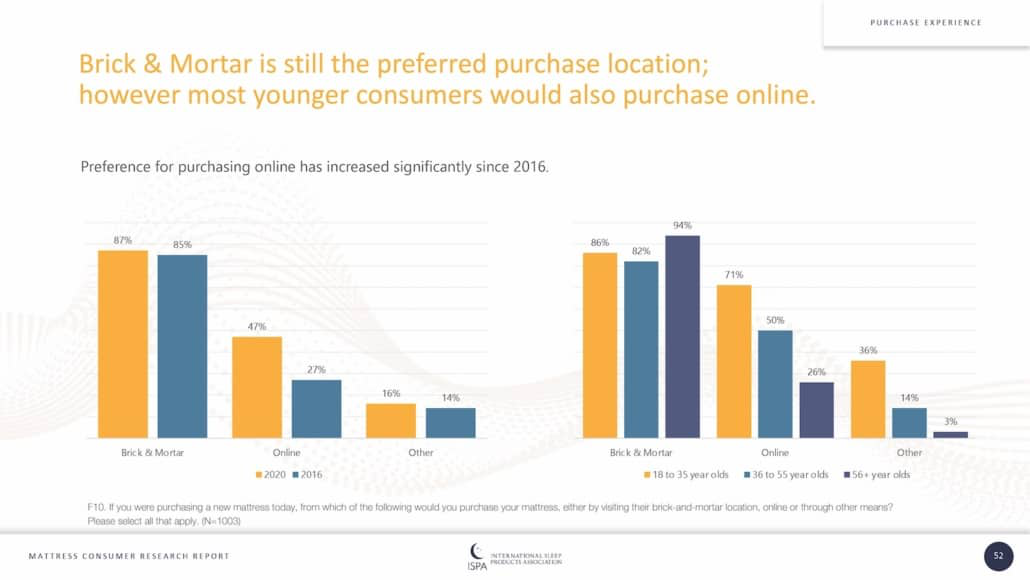

A broad consumer survey conducted by the Better Sleep Council finds growing support for online mattress purchases and declining consumer interest in using store visits as a key source of information for mattress shoppers.

The BSC survey documents key changes in the evolving mattress shopping marketplace.

The survey found good news for online and channel mattress retailers. The research found that consumers’ preference for online mattress purchases is on the upswing, particularly among younger consumers. And those younger consumers are less likely than older consumers to say that it is very important to feel and try a mattress before purchase.

While the survey found that brick-and-mortar stores remain a vital part of the retail mattress scene, it also revealed that fewer consumers consider store visits as a required source of information for mattress shopping.

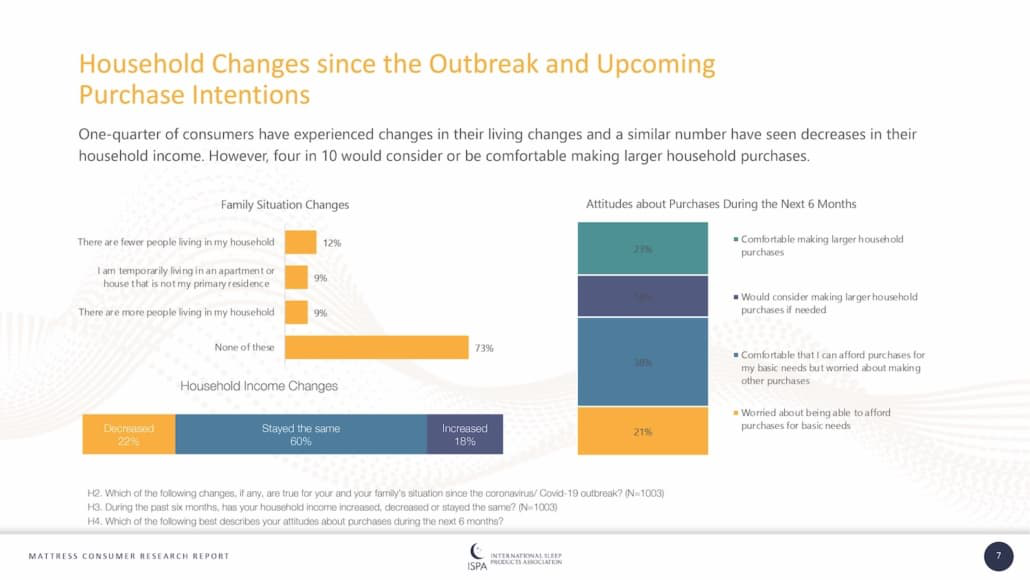

And it noted significant changes in consumers’ views on sleep as the Covid-19 pandemic made its impact felt across the country. Perhaps seeking to find extra comfort in their bedrooms, consumers staying at home were more than twice as likely as other consumers to prefer very soft mattresses.

“This Better Sleep Council research confirms consumers’ growing comfort with online mattress shopping, a trend that is accompanied by a corresponding consumer shift to considering more online research over in-store visits as part of their information-seeking process,” says Mary Helen Rogers, vice president of marketing and communications for the International Sleep Products Association. (The BSC is the consumer education arm of ISPA.) “It also provides actionable consumer insights on the Covid-19 world that the industry began experiencing last year, one that will continue this year.

“Overall, the research presents a wealth of insights that manufacturers and retailers can use to better connect with their customers,” Rogers adds. “It also provides tracking data that serves as a scorecard on industry performance on the mattress replacement cycle, a key trigger for mattress purchases.”

Following trendlines

The survey is not a new undertaking for the BSC, which has conducted consumer research on a regular basis since 1996 to understand and track changes in consumer attitudes on key issues regarding sleep and mattress buying. The last major consumer study was conducted in 2016.

“The overarching objective of this BSC research is to track trends in how and why consumers are shopping for a mattress to better inform the communication strategy of the industry,” Rogers says. “We want to give the industry a better understanding of what triggers shoppers to start the process, what they value most and what their expectations are. We want to help the industry be more successful along the buyer’s journey and be better prepared to guide and educate the consumer.”

Shopping habits and preferences

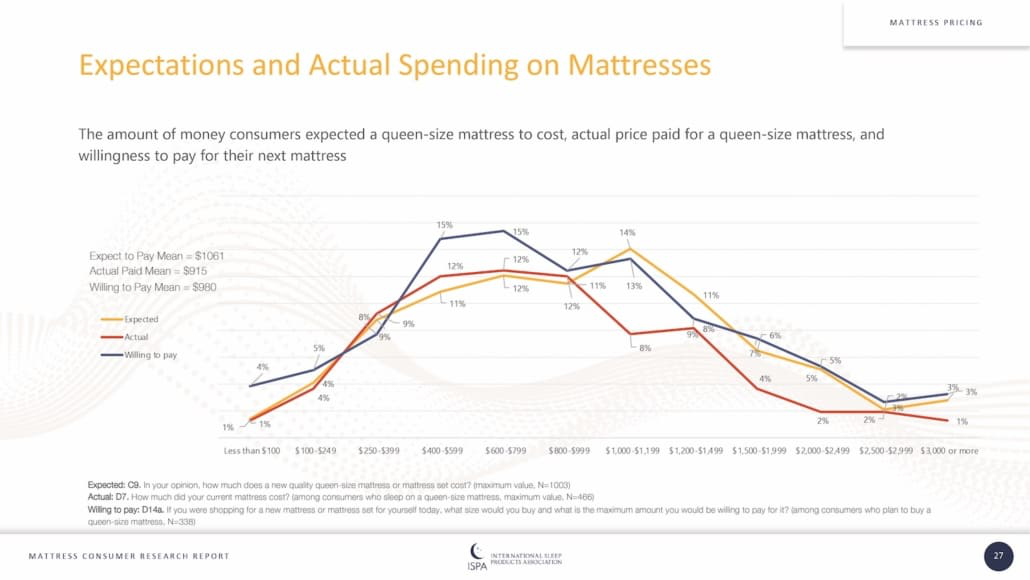

The 2020 survey found that consumers’ expectations for mattress prices and mattress replacement cycles are comparable to those found in 2016, providing a measure of stability for an industry that has seen major changes in recent years. The research also reveals that consumers’ satisfaction with their mattresses has decreased slightly since 2016, a finding that the BSC will monitor to see if a significant trend develops.

The biggest changes since 2016 relate to the shopping experience, revealing a growing preference for online mattress purchases and less focus on in-store visits as a source of information on mattresses.

Another change, of course, was the emergence of the pandemic, “which appears to have had an impact on people’s sleep and mattress preferences,” Rogers says.

Consumers under stay-at-home orders at the time of the survey this past August were more likely than others to say they are getting more than enough sleep and to say that home improvement and lifestyle factors would be a trigger for mattress replacement.

The BSC survey found five main triggers to mattress replacement, a key factor tracked by bedding manufacturers and retailers. Mattress deterioration, cited by 65% of respondents, and health and comfort, cited by 63% of respondents, are the two most common triggers for mattress replacement. Mattress improvement, which includes consumers’ desire to move up to a bigger mattress, was next, cited by 30% of respondents. Home improvement and lifestyle changes were cited as purchase triggers by 27% of respondents, while 26% said that their mattress reaching a certain age is a purchase trigger.

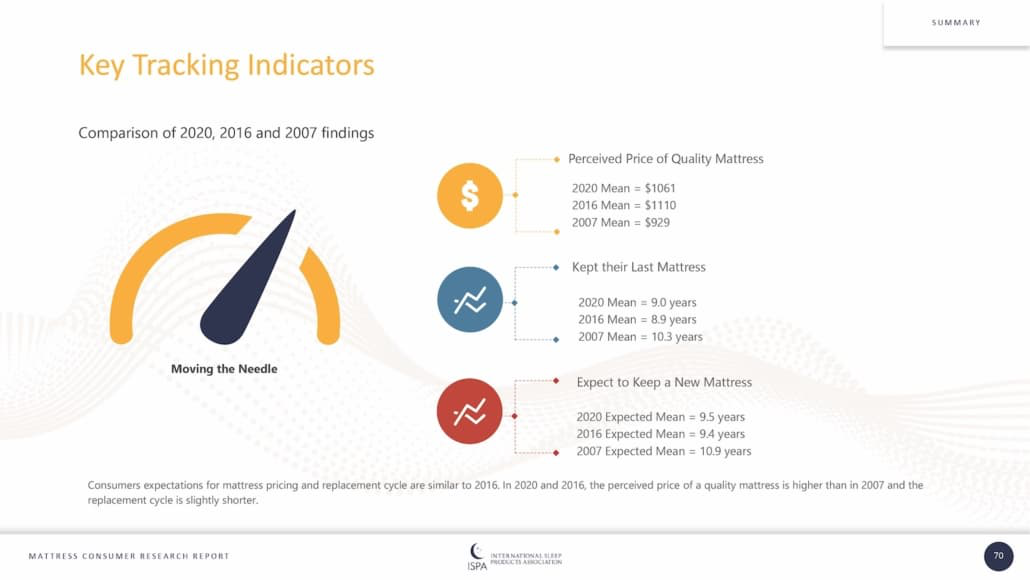

While the latest survey identified a number of changes in consumers’ attitudes regarding mattress shopping, it found that key tracking indicators have remained largely stable since 2016.

For example, in the 2020 survey, consumers said their perceived price of a quality mattress was a mean of $1,061. That is slightly less than the mean of $1,110 consumers reported in 2016, but is significantly higher than the mean of $929 consumers reported in 2007.

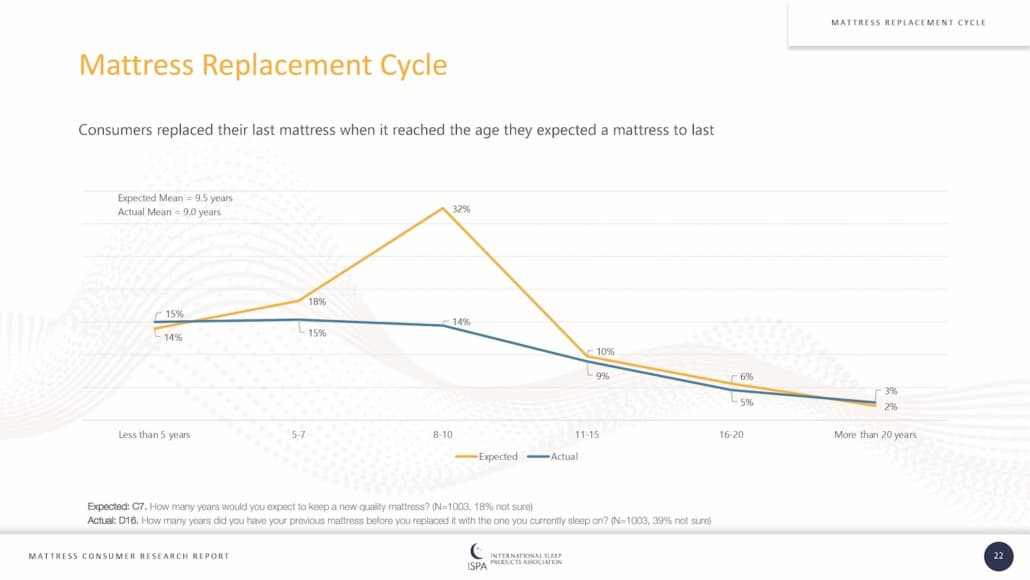

The 2020 survey found that consumers kept their previous mattress for about the same time as in 2016. The 2020 mean was 9 years, virtually the same as the 2016 mean, which was 8.9 years. But the time frame is now significantly lower than in 2007, when the mean was 10.3 years.

How long do consumers expect to keep a new mattress? The 2020 expected mean was 9.5 years, compared with the 2016 expected mean of 9.4 years. The 2007 expected mean was much higher at 10.9 years.

The demographics

The survey, conducted online by Fluent Research, was a national sample of about 1,000 consumers, all U.S. adults 18 years or older who participate in mattress purchasing decisions.

The respondents were about evenly split on gender lines, with 49% male and 51% female. They reflected a variety of ages, with 26% in the 18-35 age group, 39% in the 36-55 age group (traditionally viewed as the industry’s target demographic group) and 35% age 56 or older. Seventy-five percent of respondents were white, 14% were Hispanic and 12% were Black.

The survey respondents also represent the four major regions of the country, with 18% living in the Northeast, 22% living in the South, 37% living in the Midwest and 23% living in the West. Thirty-two percent live in an urban setting, 49% live in suburban settings, and 19% live in rural settings.

All of the respondents said they played some role in the mattress research and purchase decision-making process, with 56% of the respondents saying they are solely responsible, 18% saying they are primarily responsible, and 26% saying they participate in the research and purchase decision-making processes.

The respondents also reflect a broad range of household incomes, with 24% having household incomes of less than $30,000, 18% having household incomes of $30,000-$49,999, 34% having household incomes of $50,000-$99,999, and 24% having household incomes of $100,000 or more.

Fifty-five percent of the respondents were employed, while 45% were not employed, a figure that likely reflects the higher unemployment rates seen during the pandemic, according to the BSC.

Post time: Jan-20-2021